Live step-by-Step Property training and support

From a Real Developer Executing Everything He Teaches

No theory. No fluff.

Just RESULTS.

Join the next live session.

WHY WORK WITH ME?

1. Successfully executes teachings

2. Companies House track record

3. Primary occupation is property

Want FREE credible advice? Click here for Henry's free Deal Clinic Tuesday Webinars—every Tuesday at 7.30pm - 8.30pm.

Work With a Credible Trainer Executing Everything Taught

Henry Davis MBA

WHAT DO TO NEXT?

Joe Taylor

Lorem Ipsum

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged.

Keira Rawden

Lorem Ipsum

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged.

Joe Taylor

Lorem Ipsum

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged.

Joe Taylor

Lorem Ipsum

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged.

Keira Rawden

Lorem Ipsum

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged.

Joe Taylor

Lorem Ipsum

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged.

George Scott

George quickly learned how to leverage social media to generate leads for FREE!

As our trainer/mentor, George will share with YOU the strategies you’ll need to create a brand, stay competitive, and generate leads which you can monetise today…

Laura Muse

Robbie Dunchow

If you’re wanting to get started in developments, or just learn what it takes to scale from 0-100, then his talk contains everything you need.

Josh Chambers

a £1.4M in ONLY 18 months and raised over £300K in 2023 ALONE. He will be

sharing with you his secrets on how use Social Media effectively to have investors

coming to you.

Robbie Dunchow

If you’re wanting to get started in developments, or just learn what it takes to scale from 0-100, then his talk contains everything you need.

George Scott

George quickly learned how to leverage social media to generate leads for FREE!

As our trainer/mentor, George will share with YOU the strategies you’ll need to create a brand, stay competitive, and generate leads which you can monetise today…

Josh Chambers

Chris Taylor

He has helped his clients generate over £165m and 3m followers through his and his teams campaigns. As Chief Marketing Officer of the Pipeline 44 Group, he inspires Consultants, Serviced Based Businesses and Entrepreneurs to grab the attention of their IDEAL clients and build sustainable pipelines through Social Selling.

OPTION 1:

Book 20-Minute Discovery Call

OPTION 2:

Regular Zoom Webinars: Tuesday at 7.30pm - 8.30pm.

AUCTION GUIDE

- Avoid #1 most common mistake

- Understand missing documents

- Avoid unmortgageable property

- Understand auction recycle scam

WHAT WILL YOU LEARN?

Henry is a paid contributor to:

IS THIS YOU?

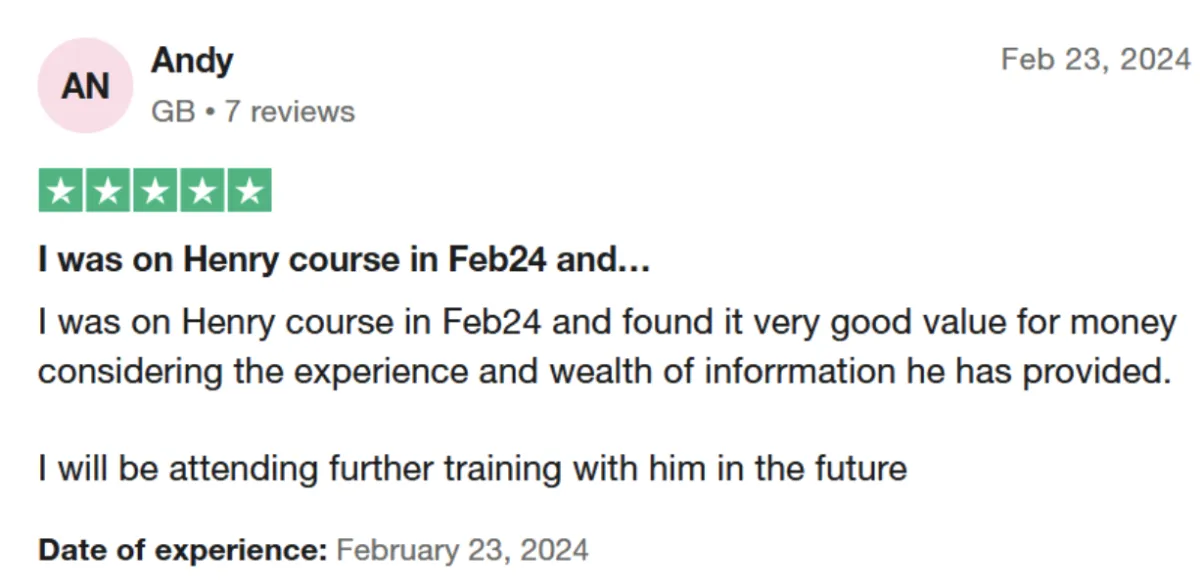

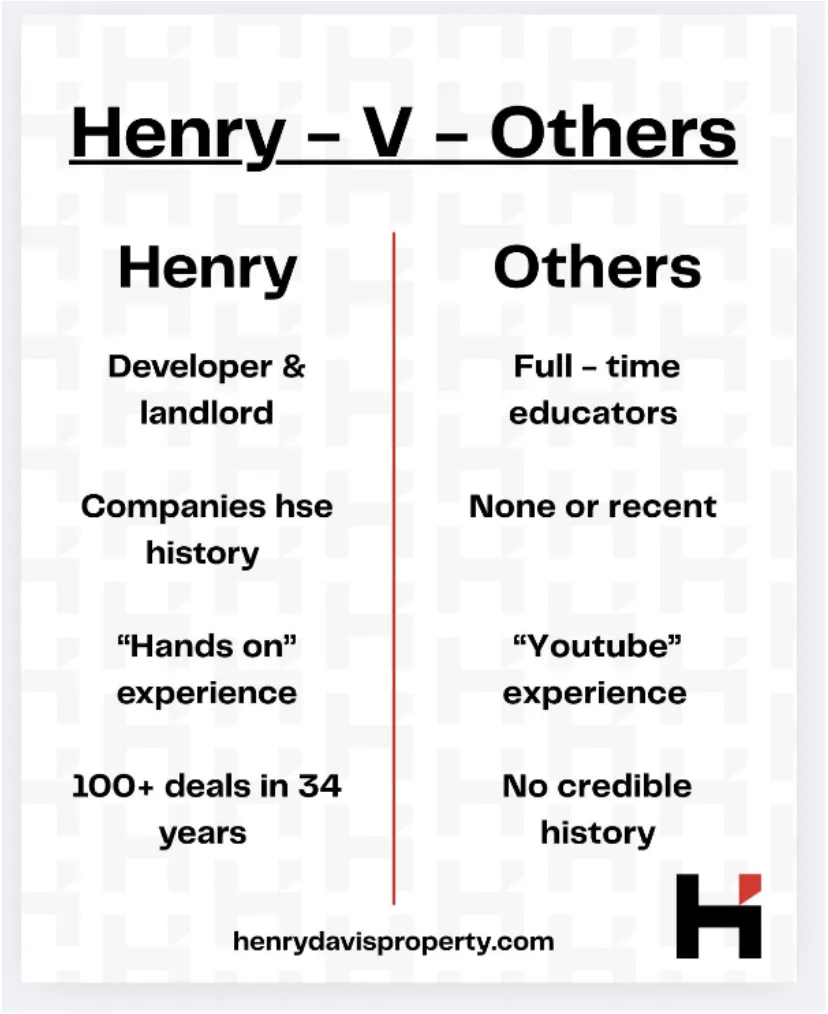

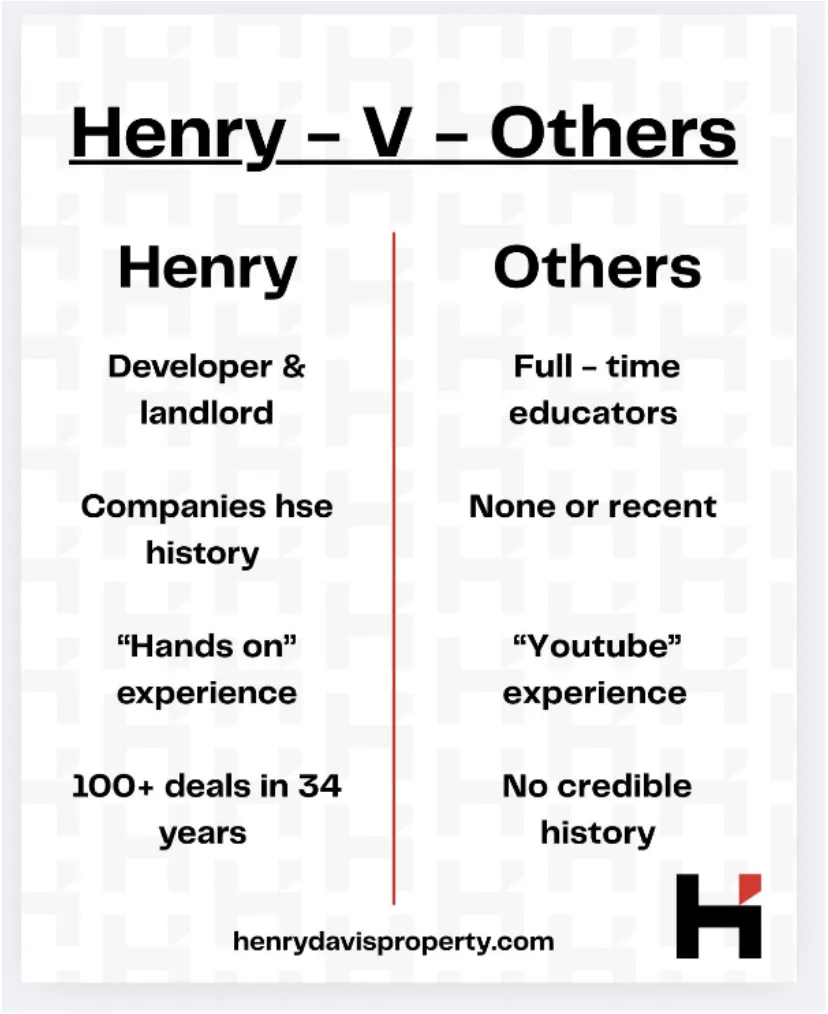

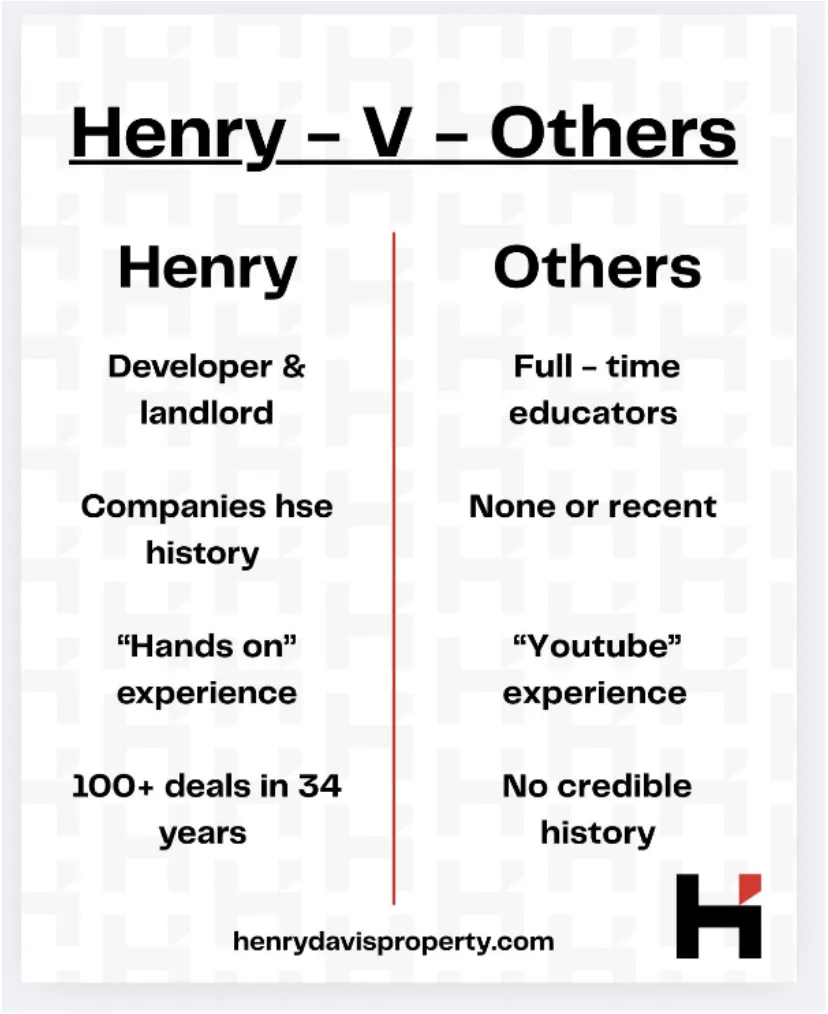

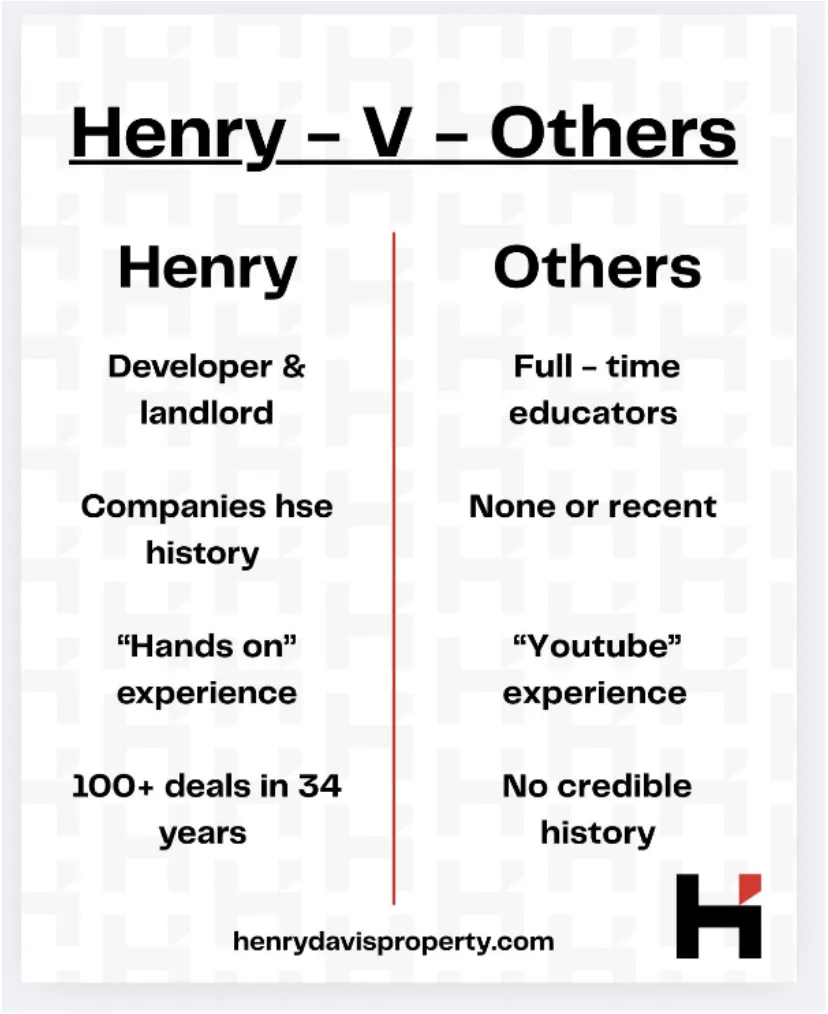

HENRY -V- FAKE TRAINERS

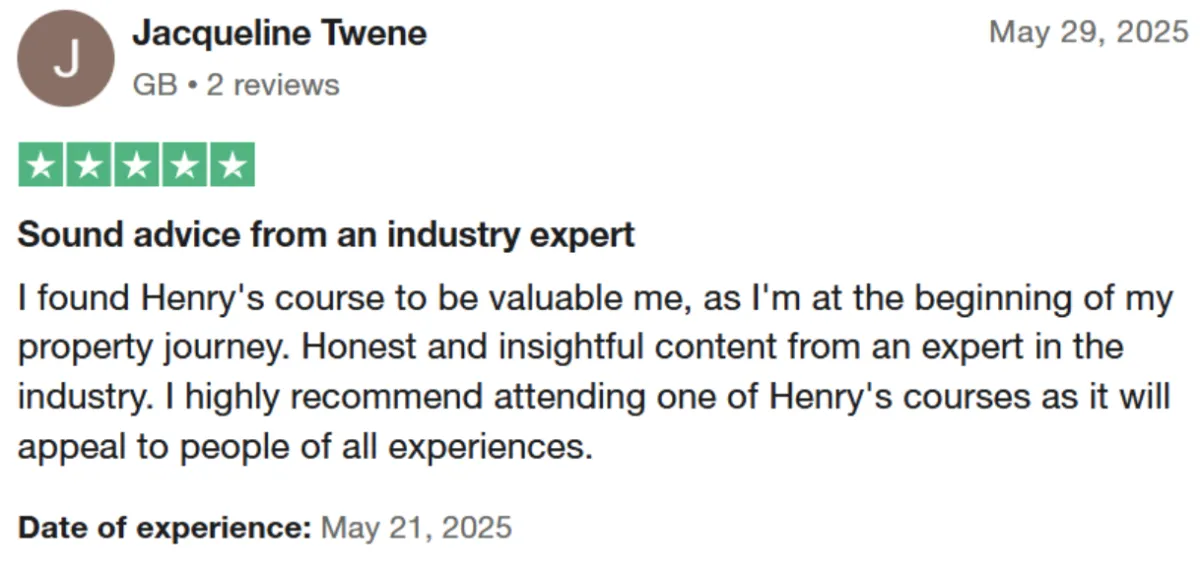

3 Decades "Hands-On" Experience

Companies House Track Record

Successfully Executes Teachings

Credible, Honest, Detailed

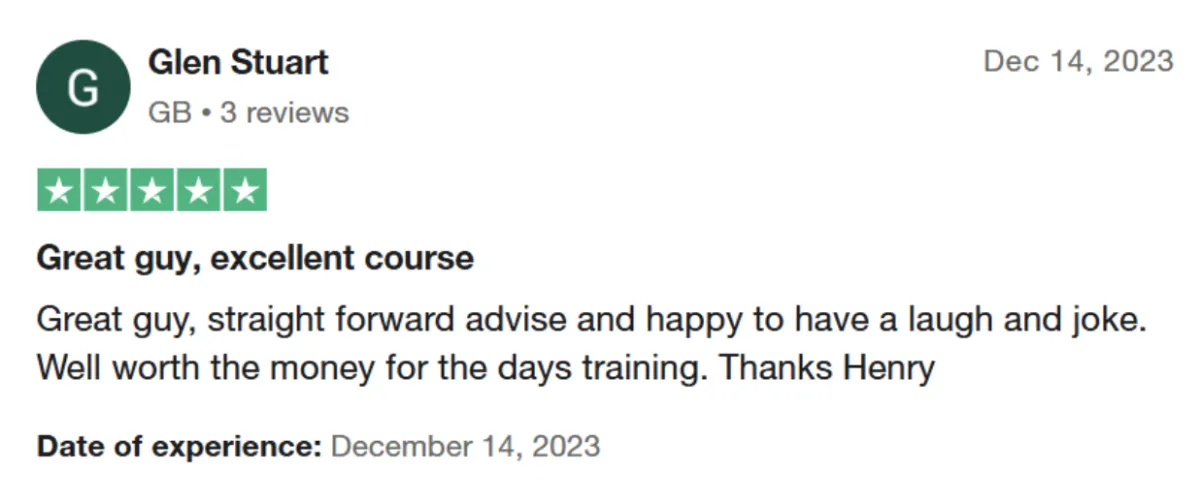

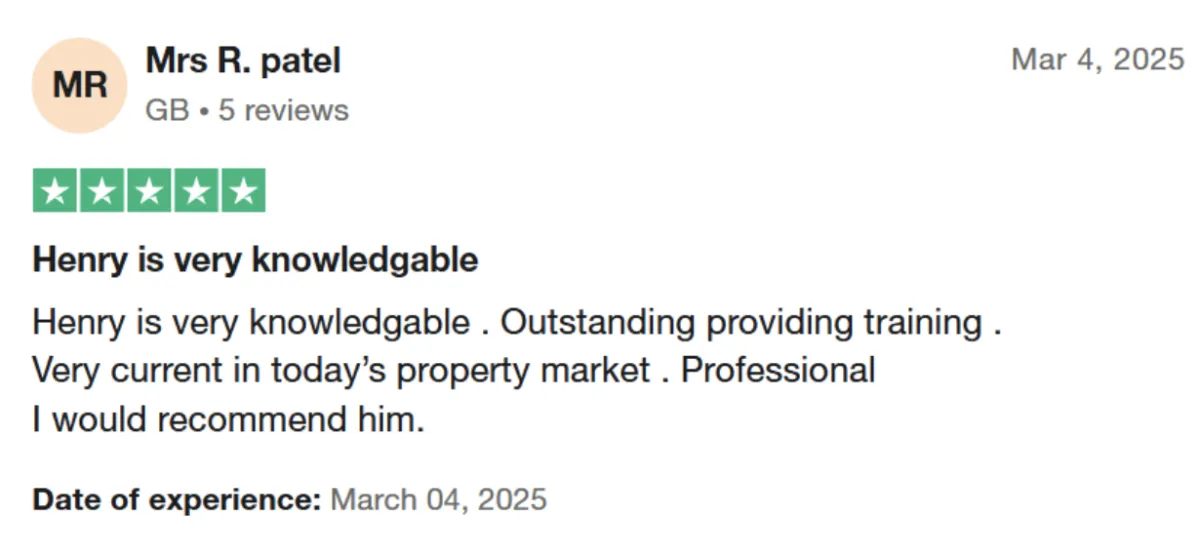

Trained 1,000+ with credible 5-star Trust Pilot and LinkedIn reviews

Agenda for the day

- 9:30am - 10:00am: breakfast/chat

- 10:00am - 10:30am: WHO and WHERE ARE/SHOULD YOU BE? (Mapping who you want to be, what platforms are for your brand) Active participation on stage bring one person do a persona audit

- 10:30am - 11:15am: Robbie Dunchow talk - How do I scale fast with no experience & low confidence? How to turn your life around.

-

11:15am - 12pm: George Scott - How to 3x your following in 60 days by the power of

Instagram Reels.

-

12pm - 12:30pm: Lunch, Network & Natter

- 12:30 - 1pm: Let's get cracking - Create and optimise those profiles

- 1:45pm - 2:15pm: Laura Muse - How I raised Millions Through Social Media to Build My Property Empire

- 2:15pm - 3pm: Let's get CREATIVE (Tom talk) - Bad content/AMAZING content - What sets you apart?

- 3pm - 3:30pm: We LOVE visuals - REELS/HOW do i do it?

- 3:30pm - 4:30pm: 12 week content plan & help from our talented team/question time.

- 4:30 - 4:45: Drink, Toilet Break!

- 4:45pm - 5:30pm: Emily Shepperson - The KEY to managing workloads/numerous commitments.

- 1pm - 1:45pm: Chris Taylor - Power of linkedin

- 1:45pm - 2:15pm: Secret Hacks & the importance of trending sounds.

- 2:15pm - 3pm: Let's get CREATIVE (Tom talk) - Bad content/AMAZING content - What sets you apart?

- 3pm - 3:30pm: We LOVE visuals - REELS/HOW do i do it?

- 3:30pm - 4:30pm: 12 week content plan & help from our talented team/question time.

- 4:30 - 4:45: Drink, Toilet Break!

- 4:45pm - 5:30pm: Emily Shepperson - The KEY to managing workloads/numerous commitments.

Trained 1,000+ with credible 5-star Trust Pilot and LinkedIn reviews

3 DECADES OF pROVEN SUCCESS

LONDON

Henry’s strategy is simple – walk the streets to find derelict buildings to reconfigure and create equity and recycle the same cash. Then reconfigure the floorplan and fit-out optimising tenant retention, practical design, and attention to detail.

Henry began trading property in London in the early 1990s. Here's a photo of his first two HMOs — side by side. (Hard to imagine now, but this was before camera phones even existed!)

Before founding International Property Group Irl, Henry had already made his mark buying/selling in London. IPG was later established in Dublin to benefit from Ireland’s low corporate tax rate.

Fun Fact: Henry drove a Sierra Cosworth RS 500 then—the UK’s most stolen car in the 1990s.

100+ Properties Bought/Sold 30 years

MARIBEL SQ

In 2004, after reading about low house price-to-earnings ratios in the North West, Henry saw an opportunity others overlooked. He partnered in a joint venture with Nick to convert a disused church (F1 use class) into 18 residential units (C3 use class).

The entire development was sold off-plan, just before a major property crash. “At the time, I believed property prices could only go up. I’d mistakenly convinced myself we’d never see another crash — but I was wrong. That experience taught me some of my most valuable lessons about market volatility and property hedging strategies.”

This project marked a turning point in Henry’s career, sharpening his awareness of risk-management, timing, and the need to at least try to anticipate economic cycles. This spurred Henry’s interest in economics and in studying the work of Howard Marks, a famous American investor.

100+ Properties Bought/Sold 30 years

CASA URBANO

After years of trading property in London throughout the 1990s, Henry completed his MBA in 2000 and then went on to co-found International Property Group, based overseas to maximise tax efficiency, while developing in the UK market.

One of Henry’s standout early projects was a Casa Urbano, a joint venture with Peter for 42 flats in Hulme, Manchester.

“The site was in distress, owned by Rosedale Developments Ltd — but in a booming market, everyone wanted crazy unrealistic money. I presented Rosedale with an IPG feasibility study backed by two independent Vaz Panel valuers. This gave them a reality check. Sometimes credible valuation evidence oils the wheels of negotiation.”

100+ Properties Bought/Sold 30 years

ST JULIES

In the early 2000s, with no contacts or network in Liverpool, Henry took a practical approach to sourcing. Armed with comfortable shoes, determination and a stack of leaflets, he hit the streets alongside his friend Clive (his plumber at the time).

They conducted a direct-to-vendor (DTV) leaflet drop, which led to one of many deals. One of the owners responded to the very leaflet shown in the image — a simple but powerful reminder of how hustle and persistence pay off.

The project involved securing C2 to C3 planning permission for 17 apartments. Once planning was granted, Henry sold the site to a buyer who, after much haggling, eventually became a lifelong friend.

“In hindsight I would have kept this one if I had to do it all again, but it made a lifelong friend in Nick, who I sold it to and built a friendship lasting over the decades.”

100+ Properties Bought/Sold 30 years

HIGH-END FLIP

Auction bidding wars! This property was purchased at auction, and Henry went in with a bold strategy — bidding in £10,000 increments.

“Luckily for me, these big bids scared off the competition — but what they didn’t know was I only had two bids in me! The auctioneer wasn’t impressed… he gave me a proper dirty look!”

Once the property was secured, as usual, Henry took on the interior design himself — with one exception.

“I’ve never been great at choosing colours, so I called in expert help. The colour scheme was designed by Lucy Roper, a talented interior designer you might recognise from DIY SOS.”

It was a perfect blend of bidding strategy, design, and low planning risk — and was sold in the peak of the Covid buying frenzy

100+ Properties Bought/Sold 30 years

Manchester

Auction bidding wars! This property was purchased at auction, and Henry went in with a bold strategy — bidding in £10,000 increments.

“Luckily for me, these big bids scared off the competition — but what they didn’t know was I only had two bids in me! The auctioneer wasn’t impressed… he gave me a proper dirty look!”

Once the property was secured, as usual, Henry took on the interior design himself — with one exception.

“I’ve never been great at choosing colours, so I called in expert help. The colour scheme was designed by Lucy Roper, a talented interior designer you might recognise from DIY SOS.”

It was a perfect blend of bidding strategy, design, and low planning risk — and was sold in the peak of the Covid buying frenzy

High-end flips

H APARTMENT

Sometimes, the best deals aren’t found online — they’re found by literally walking the streets. That’s exactly how Henry discovered this former city centre pub, which he transformed into a 14-bed HMO.

Because of the margins of the project, it allowed for a repayment mortgage — a game-changer when it comes to long-term Net Present Value (NPV) and sustainability in terms of paying down debt.

This was another classic direct-to-vendor (D2V) success story. While out walking, Henry met the owner — a kind gentleman from Birmingham — who happened to be ready to sell.

“He was a lovely man, and the timing couldn’t have been better. I finished the project, then rented it to a supported living client and created a long-term income stream from literally walking the streets.”

100+ Properties Bought/Sold 30 years

HMO BACK-TO-BRICK

These two 6-bed HMO deals came about thanks to good old-fashioned neighbourly relationships. After getting on well with the residents next door, Henry ended up buying and selling two properties on the same street — Bigham Road, L7.

The project involved a roof extension via Permitted Development (PD) and Prior Approval. To maximise space, the main bathroom was reduced to just 1.2m wide, allowing three rooms to fit on the first floor.

“It’s always worth remembering to delete the property from the VOA list during construction — that way, there’s no council tax to pay while work is underway.”

However, not everything went smoothly...

“The builder shown on the sign — AOC — actually went bust halfway through the job. It was a stressful experience, but another important lesson in getting the right QS, choosing contractors carefully and having a £ contingency in place.”

100+ Properties Bought/Sold 30 years

HIGH END FLIP

This was a rare treat — a high-end flip that required no planning permission and no structural alterations. A straightforward project, but one that still delivered stunning visual appeal – and even 12 years later, it hasn’t dated.

Henry used one of his go-to tricks: a bold tile feature wall to create a strong “Wow Factor” — perfect for clickbait-worthy marketing photos.

“It’s amazing what the right design detail can do. This feature draws people in and helps the property stand out in crowded listings.”

Mentoring clients get full access to Henry’s personal specification and supplier list and a step-by-step project management spreadsheet refined by his Quantity Surveyor, Architect, and Structural Engineer.

100+ Properties Bought/Sold 30 years

WAVERTREE NOOK

This C3 redevelopment secured full planning permission in the early 2000s — a time when the market felt simpler, margins were higher, and regulations were lighter.

It was another successful joint venture with Nick, and every flat in the scheme was sold before completion.

“Back then, it felt like deals flowed more easily. The planning process was faster, red tape was minimal, and the margins made even the challenging projects worthwhile.”

As with all of Henry’s developments, mentoring clients receive access to his complete specification and supplier list, along with a highly detailed project management spreadsheet, reviewed and refined by his QS, Architect, Structural Engineer, and CDM (Construction Design and Management) specialist.

100+ Properties Bought/Sold 30 years

DICK JENNINGS

This project involved full planning permission for a 16-bed HMO and was one of the most technically challenging developments Henry has ever taken on.

The building was unstable; all internal floors had to be removed and then reinstated, with repositioning to accommodate an additional attic dwelling. It required specialist structural scaffolding, and both the Structural Engineer and Quantity Surveyor were pushed to their limits.

“This was as complex as it gets — from navigating the planning system to accurately estimating costs on an unstable structure, every step had to be handled with absolute precision.”

Planning was escalated to the Planning Committee, so Henry had to make a detailed and technical submission during a live presentation in front of a full house of councillors during a somewhat lively and slightly hostile council planning committee meeting in 2016.

Despite the challenges, the outcome was worth it — the project achieved a 100%+ profit margin and is positive cash-flowing to support a repayment mortgage, significantly boosting the long-term Net Present Value (NPV).

“Being able to finance this HMO on a term-loan repayment basis is a game-changer for your long-term NPV cash position.” Meaning this property will be debt-free when I retire.

100+ Properties Bought/Sold 30 years

HMO BACK-TO-BRICK

This deal came through the marketing power of Henry’s “We Buy Any House” (WBAH) website — a direct-to-vendor (DTV) lead that perfectly showcases the value of a DTV strategy.

You can spot the WBAH sign on the building’s exterior — and also on many of Henry’s other projects featured as you scroll through this page.

The project followed a two-step strategy:

1. Prior Approval – Retail to Dwellinghouse conversion

2. Then upgraded to a HMO via Permitted Development (PD)

Henry futureproofed and designed the interiors and managed the fit-out, ensuring a more robust and practical design – something interior designers often forget.

“I met the owner on New Year’s Day, and strangely — no hangover that day! It turned out to be one of those lucky, perfectly timed meetings that led to a great deal.”

100+ Properties Bought/Sold 30 years

FLATS BACK-TO-BRICK

This project is one of the few purchased through Rightmove and involved a block of six flats that had suffered fire and severe structural damage. Although the restoration work brought the building up to modern standards, the original flat sizes remained below current building regulation minimums — a common issue with older conversions.

“While the layout works in practice, the smaller unit sizes mean fewer lenders are willing to finance the deal — and those who do typically charge more.”

As a result, Henry ended up paying around 1% more on the APR of his loan — a reminder of how legacy-building characteristics can impact long-term financing options and profitability.

“It’s one of those quirks of older stock — even when you do everything right structurally, the original footprint can still affect your bottom line.”

100+ Properties Bought/Sold 30 years

COMMERCIAL-TO-RESI

At the time, the average selling price in the area was £120–130 per sq ft, while build costs ranged between £80 and £80–100 per sq ft. After completing a thorough feasibility study, Henry made the decision not to develop the site himself and instead sold it with planning permission for apartments.

“The risk-reward just didn’t stack up. It would have been a high-risk, low-margin deal — and that’s exactly what a proper feasibility process is designed to uncover.”

As a bonus, the site still features Henry’s “We Buy Any House” signage — offering ongoing free advertising long after the property was sold.

“Understanding the nuances of a feasibility study is crucial. It’s not just about crunching numbers — it’s about vast experience choosing projects worth the effort.”

100+ Properties Bought/Sold 30 years

PEAKY BLINDERS

This was another successful direct-to-vendor (DTV) deal — found simply by literally walking the streets and spotting potential others missed.

It was converted under Permitted Development rights, just before the introduction of A4 planning restrictions, making the timing especially fortunate.

Initially run as an Airbnb, the property was later converted into a high-quality HMO. The design was finished to boutique hotel standard, with en-suites and detailed design throughout, but with an emphasis on practicality and robustness.

“Compared to some of the more complex developments I’ve done over the decades, this one was relatively stress-free — and the result speaks for itself.”

Thanks to its superior design and detailing, the property enjoys exceptionally high tenant retention and way above-average returns even for a HMO.

100+ Properties Bought/Sold 30 years

24-BED HMO

This ambitious project was a 26-bed HMO spread over three floors, complete with multiple kitchens to meet regulations and Henry’s tenant retention strategy.

The building had a colourful history — originally a pub, then a bank, and finally left in a badly run-down state before Henry acquired it from Home REIT, a company that later became widely known for its financial difficulties.

“It was in rough shape with badly designed layouts, but I saw the potential for something exceptional. With careful reconfiguration and the right team, we turned it around.”

For large HMOs, tenant selection is everything. Henry uses a special tenant vetting process developed over decades to create a positive community feel which dramatically improves tenant retention.

“With so many tenants under one roof, tenant retention strategy is key to 100% occupancy. Good vetting and professional management doesn’t just fill rooms — it reduces “the hassle factor” long-term.”

100+ Properties Bought/Sold 30 years

COMMERCIAL-TO-RESI

This project involved converting a Class E commercial unit (formerly a shop on the ground floor) into a dwelling house. The flats above were regularised through a Certificate of Lawfulness rather than full planning permission.

“This type of approach is often referred to as the ‘back door’ route — it’s a legitimate and strategic way to make a development compliant, saleable, and mortgageable without the red tape of full planning.”

Unlike many of Henry’s more complex projects, this was a simple development with minor structural works required — making it low risk and a faster turnaround.

The completed property was sold to Hong Kong investors, showcasing Henry’s specialist planning knowledge – reducing planning compliance time by 80%.

“This planning strategy of not applying for full PP was used by Henry — especially when speed of planning compliance and fast project turnaround were the priorities.”

100+ Properties Bought/Sold 30 years

COMMERCIAL-TO-RESI

This development followed a step-by-step planning strategy, starting with the conversion of a Class E commercial unit to a dwelling house. Henry then secured a Certificate of Lawful Use for the upper floors before progressing to a final planning application for a 16-bed HMO.

“Sometimes it’s more appropriate to build up to your final planning goal in stages — especially with complex or sensitive developments. It gives council planners fewer options and reduces risk.”

The property, originally commercial, was acquired below true market value per square foot — by Henry writing to, then staying in touch with the seller.

An important design consideration was the property’s proximity to a BMW service centre behind, visible in the project photos. Because of this, natural light for habitable rooms.

“We adjusted the floor plan to avoid habitable rooms facing the boundary — ensuring compliance and future-proofing the layout.”

This is a great example of Henry’s vast and detailed experience with design and planning and how he manages planning risk while extracting the maximum GDV.

100+ Properties Bought/Sold in 30 years

HIGH-END FLIP

This project was delivered via Prior Approval, with an extension added under Permitted Development (PD) rights — a strategy Henry has used many times to maximise space and value without the delays of full planning permission.

A high-end refurbishment and flip, this property features Henry’s signature approach: “made-to-measure” design elements that instantly create a Wow Factor — as shown in the accompanying photo.

“The key is knowing where to spend and where to save. You don’t need a massive budget — just smart choices that elevate the finish but at a cost which enhances the GDV and margins.”

Henry teaches his mentoring clients how to buy right, where to focus their renovation budget, and how to create show-stopping results without overspending.

Clients also receive full access to:

✔️ Henry’s specification and trusted supplier list

✔️ A detailed, step-by-step Fit-out and Project Management Spreadsheet, developed in collaboration with his QS, Architect, and Structural Engineer

100+ Properties Bought/Sold 30 years

NEW BUILD

City View was a joint venture between Henry’s IPG and Caro Developments Ltd, along with another partner from inside International Property Group, Henry’s overseas-based company at the time.

The apartments were successfully sold off-plan in the early 2000s, marking one of Henry’s early wins in large-scale residential development.

“I was young and a bit naive back then — and in full honesty, I blew most of the profits on my fledgling motor racing career. Not the smartest financial move, but definitely one of the most thrilling!”

This project not only delivered results but also taught Henry some of the real-world lessons that no textbook or course ever could — especially around profit retention and reinvestment!

100+ Properties Bought/Sold 30 years

INTERNATIONAL PROPERTY

Henry is the co-founder of International Property Group (IPG), which was based overseas to take advantage of the 12% corporation tax rate and We Buy Any House (WBAH) which is a trading name of Genii Developments Ltd.

What sets WBAH apart is its fair and ethical approach, particularly when dealing with distressed sellers.

“We operate with a clear policy: we will never take advantage of vulnerable situations, especially where children are present in the home. Every deal is approached with transparency and empathy.”

WBAH is well-known for purchasing complex properties, including:

- Derelict or unmortgageable buildings

- Land with or without formal planning permission

- Structurally challenging or legally complicated sites

Henry’s companies in the UK and overseas are trusted by sellers because they combine professionalism and ethical conduct — a rare combination in today’s fast-moving property market. Reputation matters!

UK and International Experience

HENRY'S BOOK

Henry offers a realistic and transparent view of what it truly means to be a landlord and property developer — not just the highlights, but the day-to-day challenges, risks, and lessons learnt over three decades in the field.

“It’s not always glamorous. Real property development involves planning setbacks, legal headaches, financing hurdles — and a lot of problem-solving.”

He also shines a light on the property training industry, dominated by sharp marketing with training not designed for the genuine interests of clients.

“In my opinion, at least 80% of property trainers are ‘colourful characters’ — great at 1-day motivation and selling but lacking any credible Companies House history or a track record of real deals executed. They promote unrealistic strategies and misinformation.”

Henry stands apart by backing up his training with verifiable experience, completed projects and honest reviews on TrustPilot and LinkedIn from real people Henry trained and mentored.

The Truth About Property – Available on Amazon

PROPERTY AUCTIONS

Henry has completed numerous deals via auction, acting both as a buyer and a seller. He’s developed knowledge of the relevant and key risks and hidden pitfalls and understands how to win against the weighted advantage of the auction house.

He is well-versed in:

Reviewing what to look for – and what is missing – in legal packs

Interpreting relevant ‘special conditions’ affecting market value

Deciphering complex legal terminology and understanding covenants and other legal language that often catches buyers off guard

“While I’m not a solicitor and don’t offer legal advice, I can help you understand what to look for — and what to question — so you can professionalise your due diligence and avoid costly mistakes.”

This kind of insight is invaluable for mentoring clients looking to approach auctions with a sense of risk management and more professional due diligence.

Extensive Auction Experience as Buyer and Seller

IN THE MEDIA

Henry is a respected writer and commentator in the UK property sector, regularly contributing to premium media outlets.

He is a paid consultant to the National Residential Landlords Association (NRLA) and contributes to their magazine as the author of the popular column “Ask the Property Doctor”. He is a paid contributor to The Times Newspaper, Times Radio, and GB News.

Major developers including Bellway and Persimmon, where he has served in an advisory capacity, have sought Henry's expertise. He was also a board member of Caro Developments Ltd.

Additionally, Henry is an official introducer for Together Loans, helping investors secure funding for complex transactions where other lending options failed.

“My role across media, lending, and development isn’t just about visibility — it’s about positioning myself as the leader in credible, honest advice.”

Paid Columnist & Speaker for Premium Media

PETROLHEAD

Outside of property, Henry is a dedicated Dad and a lifelong petrolhead.

He began racing motocross as a teenager before a career as a professional single-seater racing driver — as seen in the photo with his well-sponsored car.

Henry thrived on the business side, securing major sponsorship deals with global brands including Alliance, PepsiCo, Fujifilm, and Unilever, to name a few. He was so successful at sponsorship that he also brokered major deals for other drivers.

After racing, the passion never left. Henry still enjoys track days and is an avid fan of Formula 1, MotoGP, BTCC, and the legendary Isle of Man TT.

The Lotus and Ferrari photo was taken during a track day at Anglesey Circuit in North Wales. The Formula 1 image was the Hungarian Grand Prix. The yellow motocross bike/helmet is Henry – aged just 16! The Allianz car is Henry racing in Donnington—highlights from a lifelong love of speed.

“Motorsport taught me how to pitch to global companies where I raised substantial sponsorship funds; it also made me better at split-second decision-making and how to handle both pressure and risk — lessons I carried into my property career.”

Fuelled by Speed!

THOUGHTS LEAD TO BELIEFS

Mindset. Thinking small is a self-fulfilling prophecy. Mindset is everything, but so are outcomes, discipline, and focus. Are you watching Netflix? Or are you spending your time devising, narrating, and executing your business plan? It’s not enough to be positive and expect results—it’s more about execution, discipline, and building systems and processes. Henry is a big believer in being completely honest about his strengths and weaknesses and advocates doing a SWOT analysis on yourself. To make-it, you should have the basics right in terms of having a consistent night’s sleep, exercising, and having a reasonably healthy diet. Without these basics, you won’t be able to absorb the normal stress and pressures of a growing business or have the focus and clarity of thought, or ‘headspace’, to execute.

“People post on the internet about being positive or how to be successful, but it’s just fantasy; many are not living the life to reflect their own rhetoric; they don’t go to the next stage to actually change/challenge themselves and go outside their comfort zone. This is because of their mindset and failure to do any self-analysis of their strengths/weaknesses – so they can understand where/what holds them back or correct/diagnose blockages. Many fail to be honest with themselves, to work on themselves, or to get out of their comfort zone.”

Having said all of the above, it’s also important to enjoy the moment—have holidays to recharge and don't take yourself and life too seriously—don’t wait to be rich to be happy!

Don't Wait to be Rich to be Happy!

Still unsure?

Book a call with one of our event representatives today to ask any further questions

© HDP | A cell of Genii Developments Ltd